Marriott-Starwood merger update. SPG American Express Credit Card: what to do with it if you have one.

I received many questions about SPG (Starwood) branded American Express credit card. “What should I do now?”

Since there is very little time to make any significant changes before August 1st 2018 Marriott-Starwood Loyalty Program merger, your options are very limited.

We also have little precedence to guide us, the best one is Costco rewards credit cards switch from American Express to Citibank, and US Airlines merger with American Airlines, where Barclaycard moved Citibank. However in neither of these cases original card changed affiliations, but rather offered some other generic card within its family. So, as you can see, this is a groundbreaking move for Amex.

We also have little precedence to guide us, the best one is Costco rewards credit cards switch from American Express to Citibank, and US Airlines merger with American Airlines, where Barclaycard moved Citibank. However in neither of these cases original card changed affiliations, but rather offered some other generic card within its family. So, as you can see, this is a groundbreaking move for Amex.

I have both Business and Personal version of what used to be the best rewards credit card on the market, SPG American Express Credit Card, let me tell you what I’m doing with mine, and what other options exist.

Your Options:

-find out what is your anniversary date (when annual fee is due)

-find out when is you monthly statement closing date (points transfer within 3-4 days afterwards to your SPG rewards account)

-if your monthly statement closing date is 3-4 days before August 1st, you can always cancel your card after points transfer, but before you receive Marriott branded card, and re-apply for new Marriott branded card, taking advantage of new sign up bonus.

It can be tricky for most, since all automatic payments will have to be changed manually and you have to have income and credit score to qualify for new card.

-if your monthly statement is after August 1st, you can still do it (cancel SPG Amex, then re apply for a new one-Marriott Amex), but you will lose points accumulated during last statement if they did not transfer as of cancelation date.

-if your anniversary date is after August 1st, you will receive credit for one night stay at Marriott hotels worth 35000 Marriott points, per card, and that is a great deal! It is easily worth more than $95 annual fee. There will also be 15 days credit towards your status, and that may make a difference between Silver-Gold-or Platinum, so keep that in mind as well.

What I’m doing with my SPG AMEX cards (business and private)

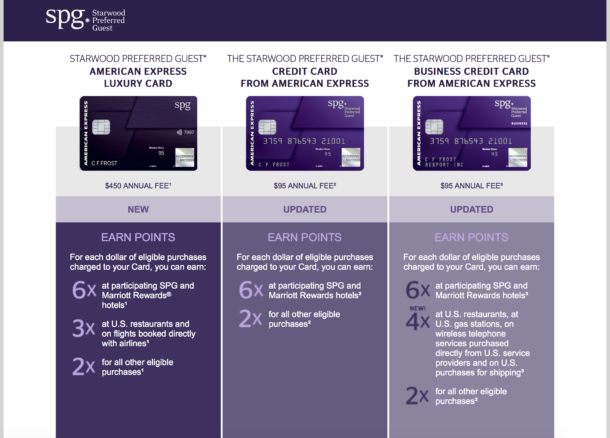

American Express Cards and SPG Benefits at Glance

-Since my anniversary date was in early Spring, I’m keeping both without changes for now.

–Next Spring, after my anniversary and receiving one night stay credit, I will upgrade my private card to The Starwood Preferred Guest American Express Luxury Credit Card. This card will come with a $450 annual fee, but a $300 credit at Marriott hotels, an annual free night award (up to 50,000 points) after card renewal, a Priority Pass membership and a slew of other credits and benefits including $100 refund for Global Entry (which I will have to renew next year). A welcome bonus has not yet been announced, but I’m sure will be significant.

-I will also try to stop or minimize the use of SPG Amex between end of July and September, to let Amex, SPG and Marriott work out any kinks in automatically transferring points and credits. I don’t think this will be an issue, but with a slew of other credit card options to use, rather safe than sorry.

If history is any guide, this should be a smooth transfer, and American Express has a history of taking care of and trying to retain its customers.

So don’t worry too, much and keep earning points.