Last Minute Check List before Marriott Rewards and SPG rewards programs merge.

On August 1, 2018 Marriot Rewards, Starwood Preferred Guest (SPG), and Ritz-Carlton Rewards will marge into a single loyalty program, an industry giant. Here is Last Minute Check List before this historic merger.

SPG and Marriott (and Ritz-Carlton) rewards loyalty program merger was long coming and well telegraphed. Both Hotel chains did great job informing their members of step by step changes. But as we well know most people don’t have time to keep up with rewards/loyalty programs and are in real danger of losing their points and perks that come with them.

SPG and Marriott (and Ritz-Carlton) rewards loyalty program merger was long coming and well telegraphed. Both Hotel chains did great job informing their members of step by step changes. But as we well know most people don’t have time to keep up with rewards/loyalty programs and are in real danger of losing their points and perks that come with them.

If you have not taken these steps you must do it now.

-if you are only SPG member, go to Marriott.com and create Marriott Rewards account.

-link all your rewards accounts together, you can do it at either Marriott.com or SPG.com website.

-open your profile in each rewards program and make sure all the information matches exactly: name, address, email and phone numbers.

-if you are only member of Marriott Rewards you don’t have to do anything.

-if you have American Express branded SPG credit cards, make sure your info on file, matches that in each reward program.

-check your credit score and last time you applied for credit card. You might benefit from canceling your Amex branded SPG before merger (make sure you don’t lose points) and applying for their new Amex Marriott credit card after August 1st, 2018. This way you can get sign up bonus points. This only works if you qualify for new credit card and can spend required minimum within 3 mos. period, so do your own diligence.

If you want more information on what joined Rewards Program will look like, both Marriott.com and SPG.com provide clear explanation.

One of the best posts explaining inner working of new program was posted by ThePointsGuy.com and his staff.

Visit https://thepointsguy.com/news/details-unified-marriott-spg-loyalty-program/ for all details read full article. I noted most important highlights below:

● The new program will have one unified loyalty account with Marriott-style points, meaning SPG points will be converted into the new program at a 1-to-3 ratio. You’ll use this one account to earn and redeem across all three chains — Marriott, SPG and Ritz-Carlton.

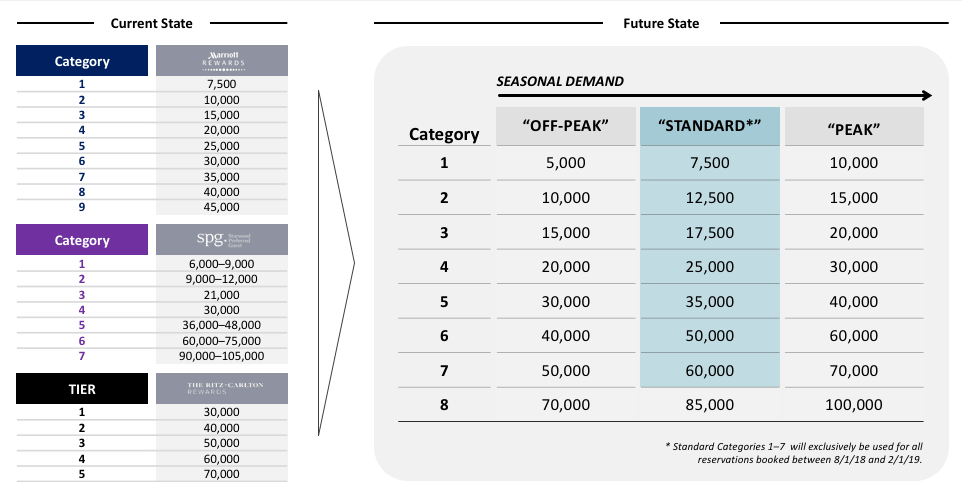

● There’ll be a single new 8-category award chart with bands for standard, peak and off-peak times of the year.

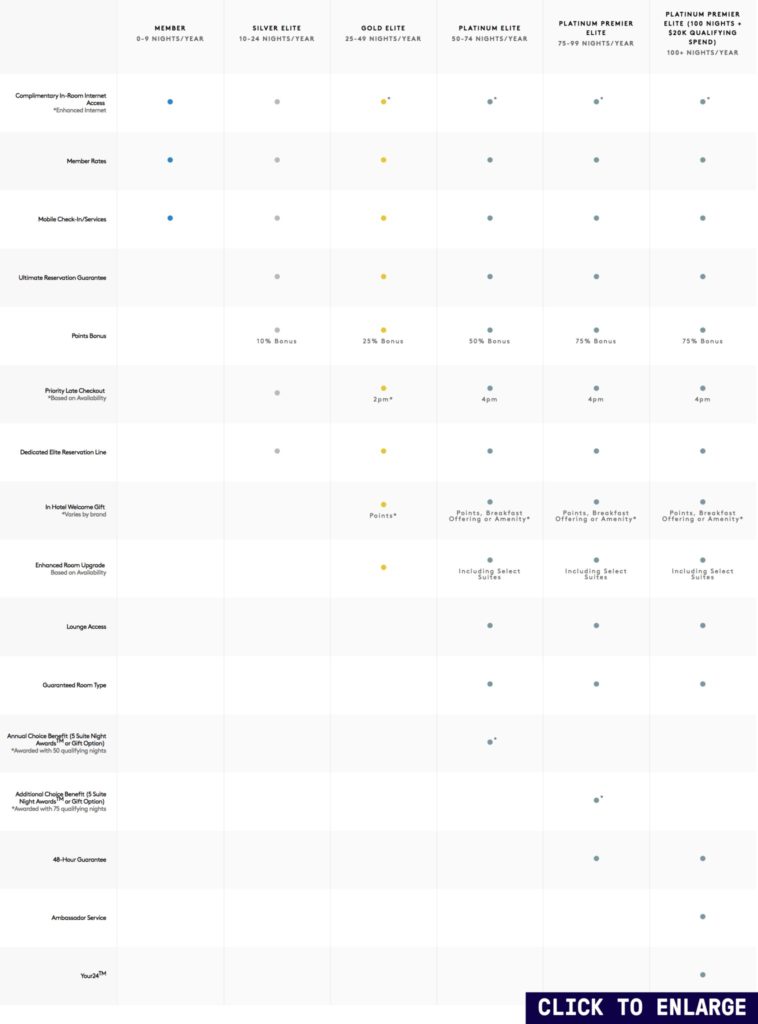

● Elite status will be streamlined into one system, but you’ll still have the option in 2018 of earning toward status under the current SPG elite system.

● Airline transfers are staying, with all the old airlines available (plus some new ones) and a transfer ratio of 3 points in the new program to 1 airline mile. And yes, there’s still a transfer bonus.

● New credit cards will be introduced by both Chase and American Express, including a brand new premium card with fee credits and an annual free night.

Merging Accounts and Earning Points

Merging Accounts and Earning Points Starting in August, Marriott Rewards, The Ritz-Carlton Rewards and SPG will combine their separate accounts into a single account that will span the entire loyalty portfolio, though the three rewards program names will live on until 2019, when a new name for the unified loyalty program will be announced. When SPG members combine their SPG points with their Marriott points into this new account, all SPG points will be tripled, essentially continuing the same 1-to-3 transfer ratio that has been in place since transfers were enabled in 2016. Non-elite members in the new program will earn 10 points per dollar spent at every brand except for Residence Inn, Towne Place Suites and Element (those three brands will earn 5 points per every dollar spent). This is huge considering SPG non-elites were only earning 2 SPG points/6 Marriott Rewards points for every dollar spent. Additionally, all members will start earning points for food, beverage and other incidental purchases on their stay at all brands. Before, some brands like Edition or Courtyard by Marriott did not award bonus points for incidental purchases.

Elite Status

The new elite tiers strongly favor Platinum members and higher — the fact that suites are included in best-available room upgrades is a major bonus. But you’ll also be able to choose to receive five Suite Night Awards at the Platinum level and an additional five Suite Night Awards at the Platinum Premier level. Marriott has informed us that members who achieved Platinum status prior to the launch of the combined program in August and chose Suite Night Awards for their choice option will receive 10 Suite Night Awards for this year. Also, according to Marriott, the breakfast offering for Platinum and Platinum Premier members will be available at 23 of the 29 participating brands, as well as all resorts.

Redeeming Points for Hotel Stay

Redeeming Points with the New Hotel Award Chart Marriott has created a whole new award chart with eight categories that will apply to all Marriott, Ritz-Carlton and SPG brands. There will be no blackout dates for point redemptions, although the brand will be introducing seasonal pricing, with off-peak, standard and peak reward rates. However, only Categories 1-7 will be used starting in August — Category 8 rates will not be used for reservations booked before 2/1/2019. Also, peak and off-peak pricing won’t be implemented until February 1, 2019. In the meantime, all hotels will be priced at the “standard” rate.

Now, we don’t know which hotels will fall under what categories yet, so it’s impossible to tell whether this is a devaluation or not overall. Marriott says it expects to begin publishing a list of properties for each redemption category on its website in June. However, a quick look at the new chart tells us that at least in some cases, the changes will be good. For instance, Category 7 SPG properties currently go for 30,000 points a night on off-peak dates. But even if the highest-tiered SPG properties end up in Category 8, the off-peak price of 70,000 points a night on the new chart essentially equals 23,333 current SPG points, so you’re effectively saving saving 6,667 SPG points.

Update, as of July 4th , 2018, Marriott assigned new hotel categories to all hotels. To find out click here.

Airline Partners

Airline Transfer Partners All our fears of Marriott eliminating one of the best parts of the SPG program can be laid to rest. The new program will be keeping SPG’s airline transfer partners, and will in fact actually improve upon it for the most part. The program will retain all of the current SPG airline partners and add 10 more for a total of 45 transfer partners. Note that some of these “new” partners already existed under the current Marriott Rewards program, but at significantly less desirable transfer ratios. Speaking of which, the 1:1 transfer ratio of SPG points to airline miles is effectively remaining the same — the difference is that now you’ll be using the new loyalty currency, so you’ll have to transfer 3 points of the new currency for one airline mile. But since all SPG points are getting converted to the new currency at a 1:3 ratio, the value of your existing SPG points effectively remains the same. The new program will also be keeping the SPG transfer bonus that offered an extra 5,000 airline miles when converting 20,000 SPG points. The new bonus will work like this: when transferring to airlines in increments of 60,000 points of the new currency, you’ll receive a 15,000 point bonus — which will net you 25,000 airline miles at the new 3:1 transfer ratio. The program really leaves the transfer bonus and ratios unchanged — it’s just inflated the numbers to match the existing Marriott Rewards.

Credit Cards

New Chase and Amex Credit Cards A new rewards program means changes were obviously coming to Marriott’s credit card portfolio, which will continue to include cards from both American Express (the current SPG issuer) and Chase (the current Marriott issuer). First, American Express will be introducing a new premium SPG card in August. The Starwood Preferred Guest American Express Luxury Credit Card will come with a $450 annual fee, a $300 credit at Marriott hotels, an annual free night award (up to 50,000 points) after card renewal, a Priority Pass membership and a slew of other credits and benefits. A welcome bonus has not yet been announced.

There will also be changes to the Starwood Preferred Guest® Credit Card from American Express and the Starwood Preferred Guest® Business Credit Card from American Express will see new perks like an annual free night award (up to 35,000 points) after card renewal and automatic silver elite status, but will lose the 2 stays/5 nights elite credit in favor of a flat 15-night per year elite credit that cannot be stacked across multiple cards. The bad news is that all three of these cards will only earn 2 points per dollar on everyday purchases, which is effectively a 33% devaluation on non-bonused spend from what the SPG cards currently offer. All SPG cards will earn 6x points on purchases at Marriott and SPG hotels. The SPG business card will also lose Sheraton club access, but will earn 4x points on purchases at restaurants, gas stations, wireless phone and shipping services. On the Chase side of the portfolio, the bank will be adding a new co-branded card called the Marriott Rewards Premier Plus Credit Card. Launching on May 3, the $95 annual fee card’s benefits will look similar to the updated SPG cards. Like the mid-tier SPG cards, the new product will earn 6 points per dollar on purchases at Marriott hotels and 2 points on all other purchases. The card will also have a 15 night elite credit (not stackable) and a free anniversary night certificate (up to 35,000 points). Best of all, the credit card will come with a 100,000 point sign-up bonus. Chase will continue to offer its current Marriott Rewards Premier Business Credit Card and The Ritz-Carlton Rewards Credit Card, but the existing Marriott Rewards Premier Credit Card will no longer be available once the new Premier Plus launches, though current cardholders will have the option to keep their cards or upgrade to the Premier Plus (Chase suggests there will be bonus offers to upgrade). However, as we’ve seen with the Chase Sapphire card line and, more recently, the Southwest Rapid Rewards cards, you’ll only be able to have one personal Chase Marriott card — either the Premier or the new Premier Plus.

Marriott-Starwood merger update. SPG American Express Credit Card: what to do with it if you have one. - PointsTravels

July 12, 2018 at 11:53 am[…] Marriott-Starwood merger update. SPG American Express Credit Card: what to do with it if you have one. […]