With strongest Airline Alliance, Star Alliance, United Airlines and its Milage Plus program is a perfect choice for an International traveler looking to redeem frequent flyer miles.

United Airlines is among the largest airlines in the U.S. and the world. It’s the dominant carrier at its home airport, O’Hare International in Chicago, and it operates domestic hubs in Houston, Newark, Denver, San Francisco, Washington (Dulles), Los Angeles and Guam.

If your home airport is a United stronghold, want to fly on international routes using rewards miles, or if you just choose to fly the carrier regularly, you’ll want to check out the airline’s frequent-flyer program, MileagePlus.

If you are new to earning Frequent Flyer Miles, do not get overwhelmed by number of details and ways to earn miles. It’s not that hard, start with signing up for free United Airlines Mileage Plus Account and then use this article to slowly get comfortable with earning miles. Remember, I am doing it for almost 20 years and I learn something new all the time.

United-New-Polaris

In this article I will go over:

● How to earn MileagePlus miles

● How to redeem MileagePlus miles

● MileagePlus program status levels

● United Airlines transfer partners

● Credit cards that earn MileagePlus miles

How to earn MileagePlus miles

United Airlines’ frequent-flyer program uses a currency called MileagePlus miles, which most travel websites values at an average of 1 cent each. You earn miles when you fly on United or one of its partner airlines, and you can redeem them for award flights. Although they’re called miles, you earn them based on how much money you spend, not how far you fly.

You can earn additional miles by spending money with United’s partners or using a United-branded credit card.

In general, MileagePlus miles will expire if you go 18 months without earning or redeeming miles on United or a partner. However, miles don’t expire for holders of MileagePlus credit cards. Buying or transferring miles also resets the 18-months clock on expiration.

EARNING MILEAGEPLUS MILES WHEN YOU FLY

United-Business-First

The number of miles you’ll earn for a flight depends on how much you spent on the ticket and your status level within the MileagePlus program. All statuses above basic membership earn mile bonuses. For example, the basic member rewards rate is 5 miles per dollar.

But at Premier Silver level, you earn a 40% bonus, which turns your rate into 7 miles per dollar.

NOTE: You earn miles only on airfare and airline fees. Government-imposed taxes and fees do not earn miles. Generally, the most you can earn on a ticket is 75,000 miles.

Earning on other airlines: Unless the ticket is issued by United, in which case miles are awarded based on fare, United’s partners in the Star Alliance award MileagePlus miles based on a calculation involving the price and class of the ticket and the flight distance.

EARNING MILEAGE PLUS MILES WITH A CREDIT CARD

United Airlines offers co-branded credit cards through Chase. This is the fastest way to accumulate non-flight miles.

My favorite credit card for the MileagePlus program is the United℠ Explorer Card (both personal and business). It gives you 2 miles per dollar spent at restaurants, on hotel stays and on purchases from United, and 1 mile per dollar on all other purchases. You get a great sign-up bonus to start: 40,000 bonus miles after you spend $2,000 on purchases in the first 3 months your account is open plus $100 statement credit after your first purchase. The annual fee is $0 for the first year, then $95 — but the checked bag benefit on this card can make up for it quickly. The first checked bag is free for you and a companion traveling on your reservation. You also get priority boarding so you can get on the plane early and find space for a carry-on bag.

Special offer

Note: Offers do vary so check them carefully. They differ from person to person as well. Sometimes after logging into your United.com account there might be a customize offer for you not available to public. My wife once got 70,000 Mileage plus miles after spending $5000 in first 3 months offer, while going average was 40,000!!!!

APPLY HERE AND NOW FOR THE BEST OFFER!!

EARNING MILEAGEPLUS MILES THROUGH PARTNERS

● Hotels.

You can earn additional MileagePlus miles at most major hotel chains. In some cases, you earn 1 or 2 miles per dollar spent; in others, you earn a flat number of miles per stay. If you are hotel rewards member, however, I recommend accumulating hotel points separately towards your specific hotel rewards program. Exception is Hilton program which lets you double dip and earn both airline miles and hotel points for a same stay.

● Dining.

Register a credit card with MileagePlus Dining, and every time you use that card at a participating restaurant, club or bar, you’ll earn up to 5 miles per dollar spent. There are more than 11,000 participating locations. Rewards are added automatically.

● Auto rentals and other transportation.

Hertz-owned rental agencies, including Dollar and Thrifty, have an option to earn MileagePlus miles. See the rules here. Amtrak rail service and select shuttles and car services are also partners.

● Shopping.

When you shop online through the MileagePlus Shopping mall, you earn miles for every dollar you spend at more than 850 retailers. This is one of the fastest way to accumulate miles in addition to flying and using credit card. I use it all the time for my regular online purchases and get 1000’s of extra miles for buying things I would buy anyway. It is very simple to use. To watch tutorial> CLICK HERE

For smartphones consider Mileage Plus X app. This will come very useful at restaurants and shopping. Huge miles multiplier if used correctly!!!! Register few credit cards and you can double dip. Use the credit cards that give you extra points for dining and office supplies at those locations and others for different shopping. For example: I use INK Chase business Visa for restaurant purchases and office supplies. I get United Mileage Plus points as advertised by Mileage Plus X app PLUS 3 points per dollar from Chase Ink for shopping at those categories. It can add up to 8 combined points and miles per 1 dollar spend!!!! For more information and tutorial> CLICK HERE

● Financial partners.

Earn miles when doing business with lending and insurance partners, among others. Look out for special offers, especially for high end individuals. Fidelity investments used to run a program giving 50,000 Mileage Plus miles for transferring $100,000 and you didn’t even had to invest it, just keep it Money Market. There were lower tier bonuses as well.

BUYING ADDITIONAL MILEAGE PLUS MILES

You can purchase additional miles through the MileagePlus website, but this is generally not a good idea. You’ll often pay far more than the 1 cent per mile.

How to redeem MileagePlus miles

united-cubes-polaris

MileagePlus miles are redeemable for flights through United Airlines and its partners in the Star Alliance.

In most cases, you redeem by booking through United’s website or by calling reservations at 1-800-UNITED1. Choose a flight, and you’ll see what the price is in cash as well as miles.

TWO TYPES OF AWARD SEATS

United Airlines offers several levels of award seats, requiring more miles for more desirable seats and cabins. They are awarded as one-way flights, so if you’re spending miles, you’ll have to apply them to both the outbound and return flights separately.

Generally, there are two kinds of award redemptions:

● Saver Awards seats are cheaper in terms of miles required to book them — 10,000 or 12,500 miles for domestic economy, for example. But they are scarcer and might not be available for the flight you want.

I’ll plan my vacations way ahead and grab them as soon as they are available. Depending on a season and destination, airlines will try to unload seats not sold shortly before travel date as well.

Important tip:

Make sure that if you are Mileage Plus Explorer credit card holder, when searching for awards flights, you are signed in into your United Mileage Plus account. There is special additional availability of saver rewards reserved for United Mileage Plus Explorer Credit card holders.

● Everyday Awards seats are more available than Saver Awards seats but require more miles.

Flyers with elite status, which United calls Premier, and eligible holders of MileagePlus credit cards have unrestricted access to book seats — even the last seat on the plane — at the Everyday Awards level.

United’s flight award chart tells you the maximum number of miles you’ll need for a given flight. Note that if you pay for a flight with miles, you don’t earn frequent-flyer miles for that flight.

GOOD REDEMPTION OPTIONS

● Free flights.

Because industry values MileagePlus miles at an average of 1 cent each, redemptions that give you at least that much value are a decent option. For example, break-even would be a flight that costs $400 or 40,000 miles. If you can book a $400 flight for 25,000 miles, that’s a good use of miles (1.6 cents per mile).

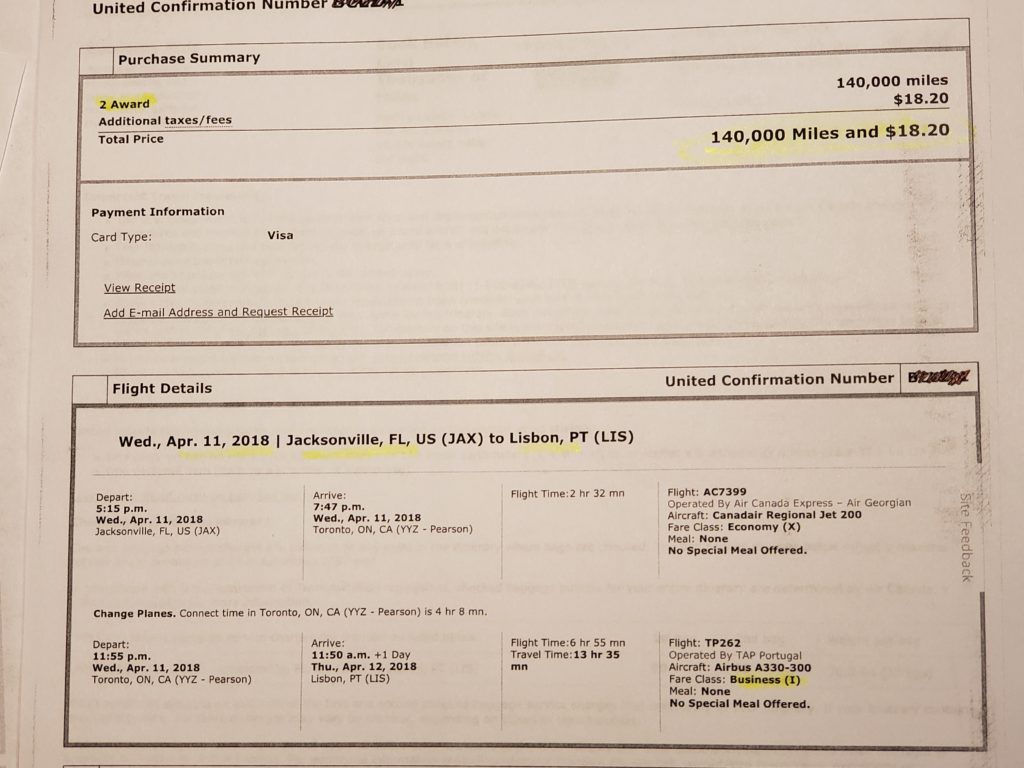

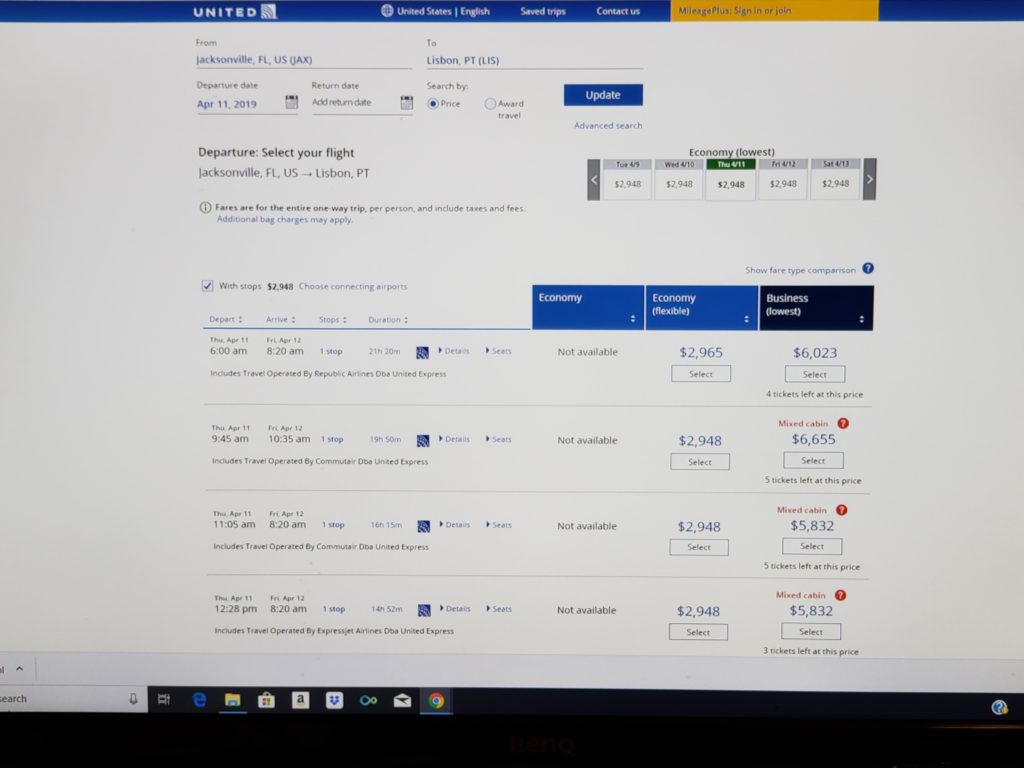

I try to use miles for most expensive multi-leg Business/First International flights. For example: If I spend 140,000 Mileage Plus Miles plus $18.20 for a 2 tickets worth $12,0000, that is 8.57 cent per mile value, yes 8.57 more then average!!!!!!! You can read about it HERE.

$12,000 saving using miles

Full price ticket

● Upgrades.

Upgrading your seat to a premium class can be another good use of miles because doing so can return value greater than a penny per mile. This is particularly great option for business traveler booked in Economy or Economy Plus with higher fare class, paid by their company. Some upgrades to business or first class require payment in the form of a cash co-pay as well as miles. As with award seats, upgrades are based on one-way flights. The price of an upgrade depends on the fare class of your current ticket — upgrading from a cheaper fare will generally cost more. Upgrade prices are also available in United’s award chart.

BAD REDEMPTION OPTIONS

As a general rule, redemptions at a value lower than 1 cent per mile aren’t good.

Other redemption options include United Club membership fees, hotel stays, car rentals, cruises and gift cards. These options tend to offer a lower value than 1 cent per mile, so I recommend avoiding them.

MileagePlus program status levels

Anyone can sign up for the MileagePlus program. It’s free to join. With basic membership, though, pretty much all you get is a frequent-flyer number and an account where your points accumulate. The real goodies comes when you earn elite status. First, we’ll look at what you get at the four elite levels of MileagePlus. Then we’ll look at what it takes to get there.

MILEAGEPLUS ELITE LEVELS AND BENEFITS

United-RDM-and-EQM

On United, elite statuses are called Premier levels. From lowest to highest, they are Silver, Gold, Platinum and 1K.

With Premier statuses, you’ll qualify for mileage bonuses, seat upgrades, priority check-in, complimentary checked baggage, better award-seat availability, discounted and waived fees, and other benefits. And if you get Gold status or better, you’ll also have lounge access when traveling internationally. Here’s a full list of all the perks you’ll receive at each level.

Note that a few of the most valuable perks of elite status are available through some of the airline’s co-branded credit cards. They include free checked bags, priority boarding, better access to award seats and even United Club airport lounge access.

HOW TO EARN ELITE STATUS IN MILEAGEPLUS

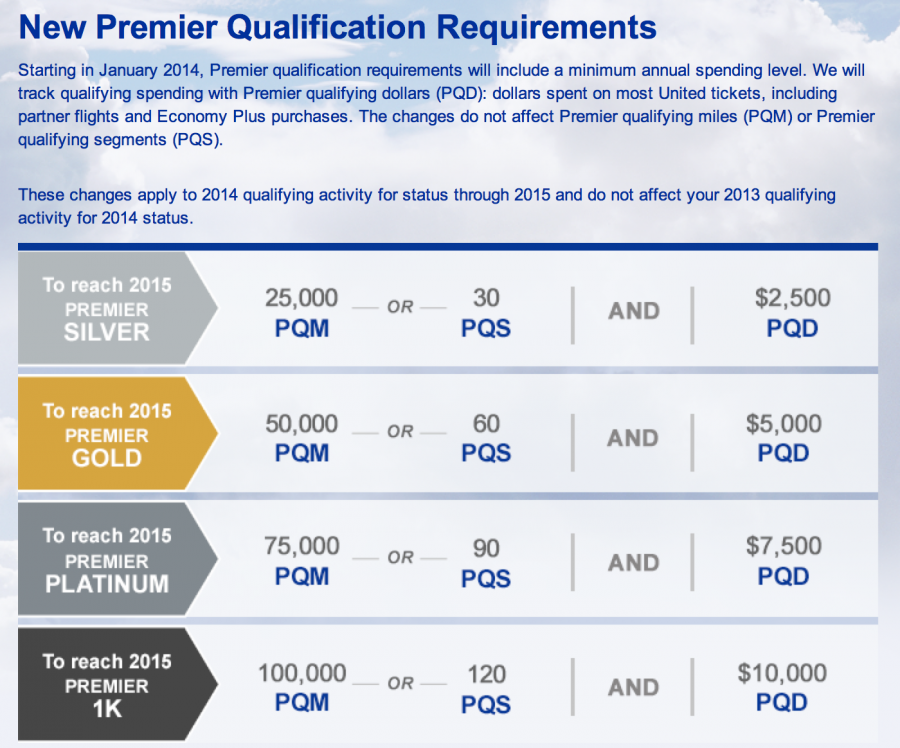

To earn MileagePlus Premier elite status, you need to do things the airline cares about as a business: fly often, fly far and spend money. That’s why you must understand the terms PQD, PQM and PQS.

● PQDs are Premier qualifying dollars. You earn them based on how much you spend on tickets with United and its partners (excluding government taxes and fees). A notable exception: If you spend at least $25,000 on a Chase MileagePlus co-branded credit card, it counts as your minimum spending requirement for all but the top Premier 1K elite status.

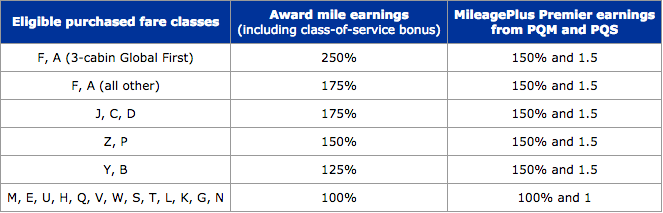

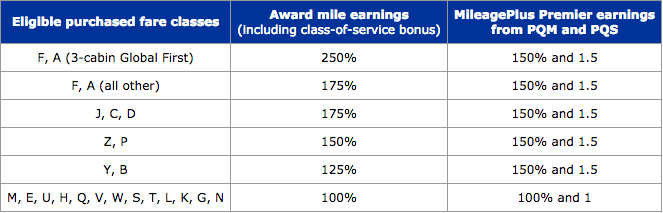

● PQMs are Premier qualifying miles. Unlike the rewards currency called MileagePlus miles, PQMs are distance-based. They’re calculated by taking the mileage of the paid flight and multiplying it by the fare class. You get more miles if your fare is in a premium cabin or if you paid full price for a coach seat rather than a discounted price, for example.

● PQSs are Premier qualifying segments. You earn them based on how many takeoff-to-landing flights you take. A nonstop flight from San Francisco to New York, for example, would be one PQS. If you had a layover in Denver, it would be two PQSs. Fare class matters here too. All elite levels require a minimum of four paid flight segments.

You don’t need to track all this math yourself. United does that and displays it in your online MileagePlus account. But the chart below shows how it works.

United-RDM-and-EQM

United, like other airlines, labels fare classes with letter codes. For example, F is first class, Y is full-fare economy and N is basic economy. Your fare class for each flight segment is displayed during booking and when viewing a ticketed itinerary on united.com.

PQDs, PQMs and PQSs are all credited to the person flying, not the person paying for the tickets. And if you used frequent-flyer miles to pay for a flight, you don’t earn any dollars, miles or segments.

ELITE-LEVEL REQUIREMENTS

To earn elite status, you need a minimum number of PQDs plus a certain number of PQMs or PQSs: Earning Premier status is based on flying and spending during the previous calendar year. Once you qualify for a Premier status, it is valid from the date you qualified through the end of the following program year. So, it could last more than 12 months.

IF YOU ARE MARRIOTT REAWRDS PLATINUM PLUS MEMBER, YOU ATOMATICALLY QUALIFY FOR SILVER ELITE STATUS WITH UNITED AIRLINES, BUT YOU MUST REGISTER.

United-Elite-Status

United Airlines transfer partners

As of January 2018, the United Airlines website identifies these as its partner airlines.

STAR ALLIANCE MEMBERS

In general, you can earn MileagePlus miles on flights with Star Alliance partners and redeem your miles for flights on Star Alliance airlines.

Star-Alliance-Partners

THIS IS WHAT MAKES UNITED MILEAGE PLUS PROGRAM MOST ATTRACTIVE TO ME AS AN AVID INTERNATIONAL TRAVELER.

● Adria (Slovenia) ● Aegean (Greece) ● Air Canada ● Air China ● Air India ● ANA (All Nippon Airways, Japan) ● Asiana Airlines (South Korea) ● Austrian Airlines ● Avianca (Brazil) ● Brussels Airlines ● Copa Airlines (Panama) ● Croatia Airlines ● Egypt Air ● Ethiopian Airlines ● EVA Air (Taiwan) ● LOT Polish Airlines ● Lufthansa (Germany) ● SAS (Scandinavian Airlines) ● Shenzhen Airlines (China) ● Singapore Airlines ● South African Airways ● Swiss International Airlines ● Air Portugal ● Thai Airways International ● Turkish Airlines

OTHER PARTNER AIRLINES

On airlines outside the Star Alliance, your ability to earn and/or redeem miles is more limited. For example, you may be able to earn miles but not redeem them, or you may be able to redeem only for certain flights. Other partner airlines include:

● Aer Lingus (Ireland) ● Aeromar (Mexico) ● Air Dolomiti (Italy) ● Azul Brazilian Airlines ● Cape Air (U.S. regional carrier) ● Edelweiss (Switzerland) ● Eurowings (Germany) ● Great Lakes Airlines ● Hawaiian Airlines ● Silver Airways (Florida)

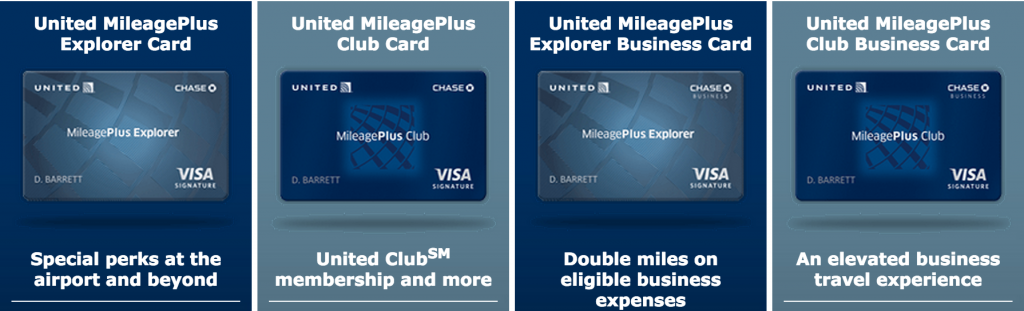

CO-BRANDED CREDIT CARDS

This is the fastest way to accumulate miles, especially if you qualify for a sign up bonus.

Keep in mind, that if you are a business owner, there is a separate credit card you can have for your business spending, and you get sigh up bonus miles as well.

Credit cards that earn MileagePlus miles United Airlines co-branded cards are issued by Chase. Cards that earn MileagePlus miles include:

united_creditcards

United℠ Explorer Card (what’s in my wallet)

● 2 miles per dollar on eligible United Airlines purchases, hotel stays and at restaurants ● 1 mile per dollar spent on other purchases

United MileagePlus® Club Card

● 2 miles on every dollar spent on eligible United Airlines purchases ● 1.5 miles per dollar spent on everything else ● United Club membership

United Airlines Mileage Plus Explorer Business Card (I have one of those as well)

● Earn 2 miles per dollar spent on restaurants, gas stations, office supplies stores and United tickets ● Earn 1 mile per dollar spent on all other purchases

United MileagePlus Club Business Card

● Earn 1.5 miles per dollar on every purchase ● Earn 2 miles per dollar on United ticket purchases

Another United co-branded card for consumers, the United℠ TravelBank Card, does not earn MileagePlus miles.

1:1 TRANSFER BUSINESS CREDIT CARD

Ink Business Preferred℠ Credit Card

- Earn 80,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. That’s $1,000 toward travel when you redeem through Chase Ultimate Rewards®

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Earn 1 point per $1 on all other purchases – with no limit to the amount you can earn

- Points are worth 25% more when you redeem for travel through Chase Ultimate Rewards

- Redeem points for travel, cash back, gift cards and more – your points don’t expire as long as your account is open

- No foreign transaction fees

- Employee cards at no additional cost

- $95 Annual Fee

- APPLY HERE FOR BEST OFFER

United Polaris

American Airlines AAdvantage Program: Best for First Class Domestic and Caribbean Award Travel - PointsTravels

July 20, 2018 at 5:17 pm[…] (You can see why United Airlines Star Alliance is far superior) […]

Delta Airlines SkyMiles Program: Best for Upgrades, Frequent Fliers and Last Minute Flights Using Award Miles. - PointsTravels If you are Frequent Flyer on Delta Airlines, use your award miles mostly for upgrades, or are looking for last minute award flig

July 22, 2018 at 4:28 pm[…] dates in other frequent flier programs if you are willing to use more miles!!! See, my articles on United Airlines and American […]

Introduction To Airline Rewards Programs: How do they work and are they for you? - PointsTravels

July 22, 2018 at 4:39 pm[…] the following series I will review major Airline Rewards Programs: United, Delta, American, Southwest and I will look at British Airways Avios as […]